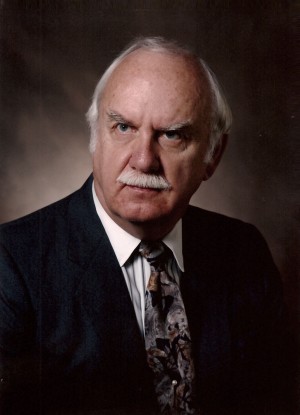

Strathmore's Roundtable Biography for

Jennifer L. Wick

| Jennifer L. Wick |

| Industry | Private Equity/Alternatives |

| Title | Chief Investment Officer and Group Strategic Finance |

| Expertise | Investment Management, Capital Raising; Languages: (Spanish, French, German) |

| Current Organization | Consensus Business Group |

| Type of Organization | Asset Management |

| Major Product | Creating funds in cleantech and alternatives; Financing for Group assets including private equity, real estate and other asset classes; M&A activity surrounding assets including disposals, acquisitions and secondary transactions |

| Area of Distribution | National/International |

| University/Degree | Ecole International de Genève, Geneva, Switzerland, 1980; B.A., Cum Laude, Wheaton College, MA, 1984; M.B.A., London Business School, 1992 |

| Honors & Awards | Awarded honours for thesis on "The International Debt Crisis"; Member, Omicron Delta Epsilon (International Honour Society in Economics); Awarded Fellowship by RSA for contribution to British Industry, 2001 |

| Affiliations | Association of Investment Directors; Board Member, Aberdeen Private Equity; National Society for the Prevention of Cruelty to Children (NSPCC) |

| Hobbies & Sports | Skiing, opera |

| Career Accomplishments | Has managed over $600 million in private equity funds, listed vehicles, cleantech investments, alternatives, real estate and secondary private equity fund transactions and raised over $1.2 billion of financing for the Group; Restructured a LSE listed fund by replacing the Board and changing the investment manager to Aberdeen Asset Management and became a Board Member; Respected by her peers and is viewed as a mentor by young professionals of Consensus and further demonstrates philanthropic behavior by volunteering for the National Society for the Prevention of Cruelty to Children (NSPCC). |

| Work History | Chief Investment Officer and Group Strategic Finance of Consensus Business Group ("CBG") having joined in November 2005, has managed over $600 million in private equity funds, listed vehicles, cleantech investments, alternatives, real estate and secondary private equity fund transactions and raised over $1.2 billion of financing for the Group; Has restructured a LSE listed fund and changed the Manager to Aberdeen Asset Management and became a Non-Executive Board member; Previously the Chief Financial Officer and Management Board Member of Brainpower N.V., a company she took public on the Prime Standard of the Frankfurt Stock Exchange in September 2000; She began her career in investment banking in mergers and acquisitions and raised capital for financings and large initial public offerings between 1992-2005 |

| Full biographical and contact details are available to logged in members only. If you are a member please log in using the form in the header to see more data. If you are not already member you may Click Here to Register for consideration. | |