VIP Biography for

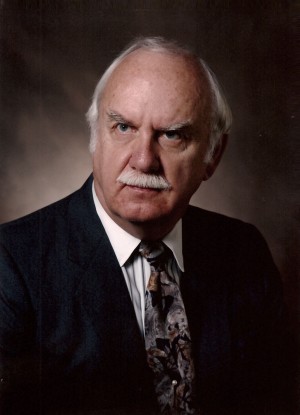

Roger J. Jones

| Roger J. Jones |

| Industry | Law |

| Title | Partner |

| Current Organization | Latham & Watkins, LLP |

| Type of Organization | Law firm |

| Major Product | Legal services |

| Area of Distribution | National/International |

| University/Degree | B.A., Mathematics and History, 1973; M.A., History, 1976; Ph.D., History, 1979; J.D., 1983, State University of New York at Buffalo |

| Born | January 17, 1951, Buffalo, New York |

| Honors & Awards | 2010 Distinguished Alumnus Award for Private Practice, The University at Buffalo Law Alumni Association; Chambers USA-America's Leading Lawyers for Business, 2004, 2005, 2006, 2007, 2008, 2009, 2010, 2011; Legal 500 US Guide, 2010, 2011; World Tax, 2010-recommended attorney; Illinois Super Lawyers, 2005, 2006, 2007, 2007, 2009, 2010, 2011; International Tax Review "The World Directory of Tax Advisors" 2001 and 2010 |

| Published Works | Author, "Staying Out of the Lion's Den", The European Lawyer, Sept. 2003; "Intercompany Pricing: Getting It Right and What Happens If You Don't", Taxes, Dec. 1994; "Absolute Power Corrupts Absolutely: Basis Overstatement and the Six-Year Limitations Period-Should the IRS Be Allowed to Re-Write the Law Retroactively?", 52 Tax Management Memorandum 235, June 2011; "Gift Card Programs: Will the IRS Allow Income Deferral for Giftcos?", Tax Notes, Vol. 130, No. 5, Jan. 2011; "To What Extent Can Treasury Abandon or Overrule INDOPCO?", Tax Notes, Vol. 127, No. 5, May 2010; "Bakersfield: Overstatement of Basis is Not 'Omission of Gross Income' that Triggers Extended Six Year Limitations Period for Assessing Tax", The Lawyer's Brief, Vol., 29, No. 22, Nov., 2009 |

| Affiliations | American Bar Association; Illinois Bar Association; New York Bar Association; admitted in Illinois, New York; admitted to U.S. Supreme Court; U.S. Courts of Appeals - 2nd, 6th, 7th, 8th, 9th, 10th and 11th Circuits; U.S. Tax Court, Court of Federal Claims |

| Hobbies & Sports | Horseback riding, skiing, hiking |

| Career Accomplishments | Frequent speaker at seminars, symposia and conferences on varied tax topics; Editor, International Trade and Business Law Annual, 1999-present; Member, Dean's Advisory Council, John Lord O'Brien Law School, S.U.N.Y. at Buffalo, 1999-present; has litigated more than 50 Federal and state tax cases at the trial and appellate levels, including Tribune Co. v. Commissioner, The Limited, Inc. v. Commissioner, Nestlé Holdings Inc. v. Commissioner, Tele-Communications Inc. v. Commissioner, and Westreco Inc. v. Commissioner; extensive experience with IRS administrative proceedings |

| Work History | Tax and ERISA Associate-Phillips, Lytle, Hitchcock, Blaine & Huber 1984-86; Tax Associate-Mayer, Brown & Platt 1987-90; Partner, Tax Controversy Practice-Mayer, Brown, Rowe & Maw, 1991-2005; Partner, Tax Controversy Practice, Latham & Watkins, LLP, 2005-present; Adjunct Professor-Chicago-Kent College of Law 1994-99 |

| Area of Practice | Federal and state tax law, specializing in tax controversy, tax litigation and appellate advocacy |

| Children | Robert E. Jones, 1970; Deanna E. Mustafa, 1977; 4 grandchildren: Edward Jones, 1998; Ethan Jones, 2002; Joseph Mustafa, 2001; Alexander Mustafa, 2004 |

| Spouse | Karen Krawczyk |

| Married | May 2, 1970 |

| Full biographical and contact details are available to logged in members only. If you are a member please log in using the form in the header to see more data. If you are not already member you may Click Here to Register for consideration. | |